All about Student Health Cover for Australia – Overseas education might be a strong aspiration to every student. Countries like Canada, Australia, the United States, and the United Kingdom are the most sought-after for students to study in.

When applying for a student visa, there are some common documents required including,

1. Funding Documents

2. Fee Receipts

3. Net Worth Certificate

4. IELTS or Any Other Language Proficiency Test Score Card and most importantly,

5. Medical Insurance and Student Health Cover

In this blog, we are going to discuss in detail about the Overseas Student Health Cover for International Students in Australia.

What is an OSHC ?

Overseas Student Health Cover is a medical insurance that should be taken by the international students who travel to Australia to study. You can drive out the tension of your health care and be worry free and focus on your education with this Overseas Student Health Cover in Australia.

Basically, it is a requirement for international students to maintain adequate health insurance to apply for an Australian student visa. Your Health Insurance policy should be up to date while you are residing in Australia with a student visa.

With this, international students can meet their medical and hospital expenses that might incur while in Australia. When your visa status or your Medicare eligibility changes, it is advised to inform you insurer as early as possible to check if your cover is still suitable.

What will be covered in your Student Health Cover?

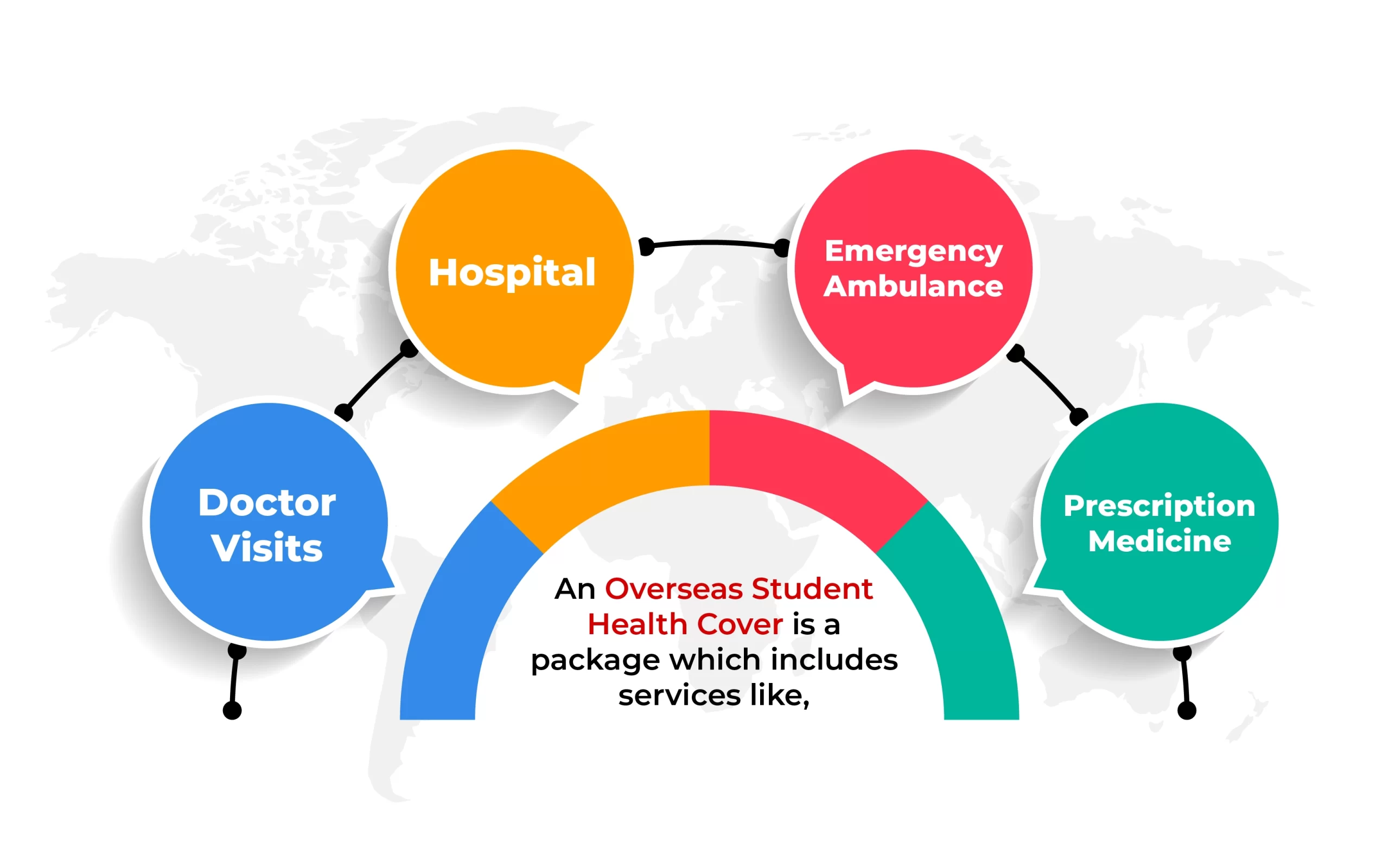

An Overseas Student Health Cover is a package which includes services like,

1. Doctor Visits

2. Hospital

3. Emergency Ambulance

4. Prescription Medicine

For some countries the applicant will need to have the Health Cover ready to apply for a student visa. And Australia is one such country. International students in Australia will need to have their Overseas Student Health Cover in hand to apply for a student visa.

General treatments like Dental, Physiotherapy and Optical will not be covered in this but if you require that cover too, you can subscribe to the Extras OSHC provided by the Australian Private Health Insurer.

Notables of OSHC in Australia…

Providers: Several insurance providers offer OSHC policies in Australia. Some of the most well-known providers include,

1. Medibank

2. Bupa

3. ahm OSHC

4. CBHS International Health

5. Allianz and

6. NIB

You can compare their offerings to find the one that suits your needs best.

Tip: You can consult an overseas education expert like CanApprove who will help you in end-to-end student visa process to countries such as Australia, Canada, The USA, The UK, New Zealand, Germany and Europe!

Cost: The cost of OSHC varies depending on the provider, the duration of coverage, and the level of coverage you choose. It’s essential to compare different policies to find one that fits your budget and covers your needs adequately.

Visa Requirement: To obtain an Australian student visa, you must purchase OSHC from an approved provider. You can buy it either through your educational institution during the enrolment process or directly from an insurance provider.

Renewal: If your course in Australia is extended, you’ll need to renew your OSHC. Make sure to keep it up to date to comply with your visa requirements.

Waiting Period: Some services may have waiting periods, meaning you’ll need to wait a specific period after purchasing OSHC before you can claim benefits for those services. Check with your insurance provider for details.

Claim Process: If you need to use your OSHC, you will typically need to pay for the services first and then submit a claim to your insurance provider for reimbursement. Keep all receipts and documentation.

Additional Coverage: While OSHC provides essential medical coverage, you may also want to consider additional insurance for things like personal belongings and travel insurance for any trips you take while in Australia.

Applying for OSHC in Australia

The considerations for applying for OSHC in Australia are as follows…

Enrolment in a Recognized Course: You should be enrolled in a recognized course of study in Australia. Generally, this includes full-time courses offered by an Australian educational institution, such as universities, colleges, and vocational education and training (VET) providers.

Duration of Cover: OSHC policies are available for different durations, so you need to ensure that your OSHC coverage matches the length of your student visa.

Payment: You will need to pay for your OSHC policy in advance. You can choose the OSHC provider and policy that best suits your needs and budget. Various insurance providers offer OSHC, and you can compare their coverage and prices to find the most suitable option for you.

Age Limit: Some OSHC providers may have age limits for purchasing policies. While most international students can obtain OSHC, some providers may have different criteria based on age.

Family Members: If you are bringing family members with you, such as a spouse or dependent children, you can also arrange OSHC for them and make sure to include their information in your OSHC application.

Summing – up!

Are you perplexed about filing for an Australian student visa? Stuck somewhere to understand the know-hows of the process? Feel free. CanApprove is here to help you. Our Overseas Education coordinators will help you with your student visa application and all the other requirements. Connect with us right away!

Thanks for reading 😊