Canadian Tax Laws

The importance of taxes in Canada is something crucial in the economic performance of a country. There are various financial aspects that will be influenced by the taxes that a country collects.

Canadian tax laws will make impact in the overall federal operations in a country. From revenue generation till debt reduction, the impact that the Canadian Tax Law makes is pretty huge. Let us discuss in detail.

Revenue Generation: Taxes are a primary source of revenue for governments. They fund essential public services such as education, healthcare, infrastructure, and defence.

Public Services and Infrastructure: Taxes enable the government to provide public goods and services that contribute to the overall well-being of the population. This includes roads, schools, hospitals, and other vital infrastructure.

Redistribution of Wealth: Progressive tax systems can help reduce income inequality by taxing higher-income individuals at higher rates and using the revenue for social welfare programs that benefit lower-income citizens.

Economic Stability: Governments use fiscal policy, including taxation, to manage the economy. Adjusting tax rates can influence consumer spending, investment, and overall economic activity.

Social Programs: Tax revenue is often allocated to fund social programs such as welfare, unemployment benefits, and public assistance, providing a safety net for those in need.

Regulation and Control: Tax policies can be used to regulate certain behaviours, such as discouraging harmful activities like smoking or encouraging environmentally friendly practices.

National Security: Taxes in Canada contribute to funding defence and security measures, ensuring the safety and protection of a country and its citizens.

Debt Reduction: Taxes in Canada can be used to pay off national debt, reducing the financial burden on future generations.

Types of Taxes in Canada

Canada is a country bound by laws and there is a stringent taxation system followed in the country. There are various taxes formulated by the Canadian Tax Laws in the Canadian jurisdiction and they are as follows.

Income Tax in Canada

Individuals and businesses are required to pay income tax in Canada on their earnings.

Goods and Services Tax (GST)/Harmonized Sales Tax (HST)

There are consumption taxes such as the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) that apply to certain goods and services.

Corporate Tax

Federal Corporate Tax Rate: The federal corporate tax rate is applied to taxable income earned by corporations operating in Canada. The rate may vary based on the type of income and the size of the corporation.

Provincial/Territorial Corporate Tax Rates: In addition to the federal rate, provinces and territories have their own corporate tax rates, which can vary. The combined federal and provincial/territorial rates determine the total corporate tax rate.

38% of your taxable income is the basic Part I tax rate; 28% of that amount is after federal tax abatement. The net tax rate is 15% following the general tax cut. The net tax rate is 9% for private corporations under Canadian ownership that claim the small business deduction.

Personal Income Tax in Canada

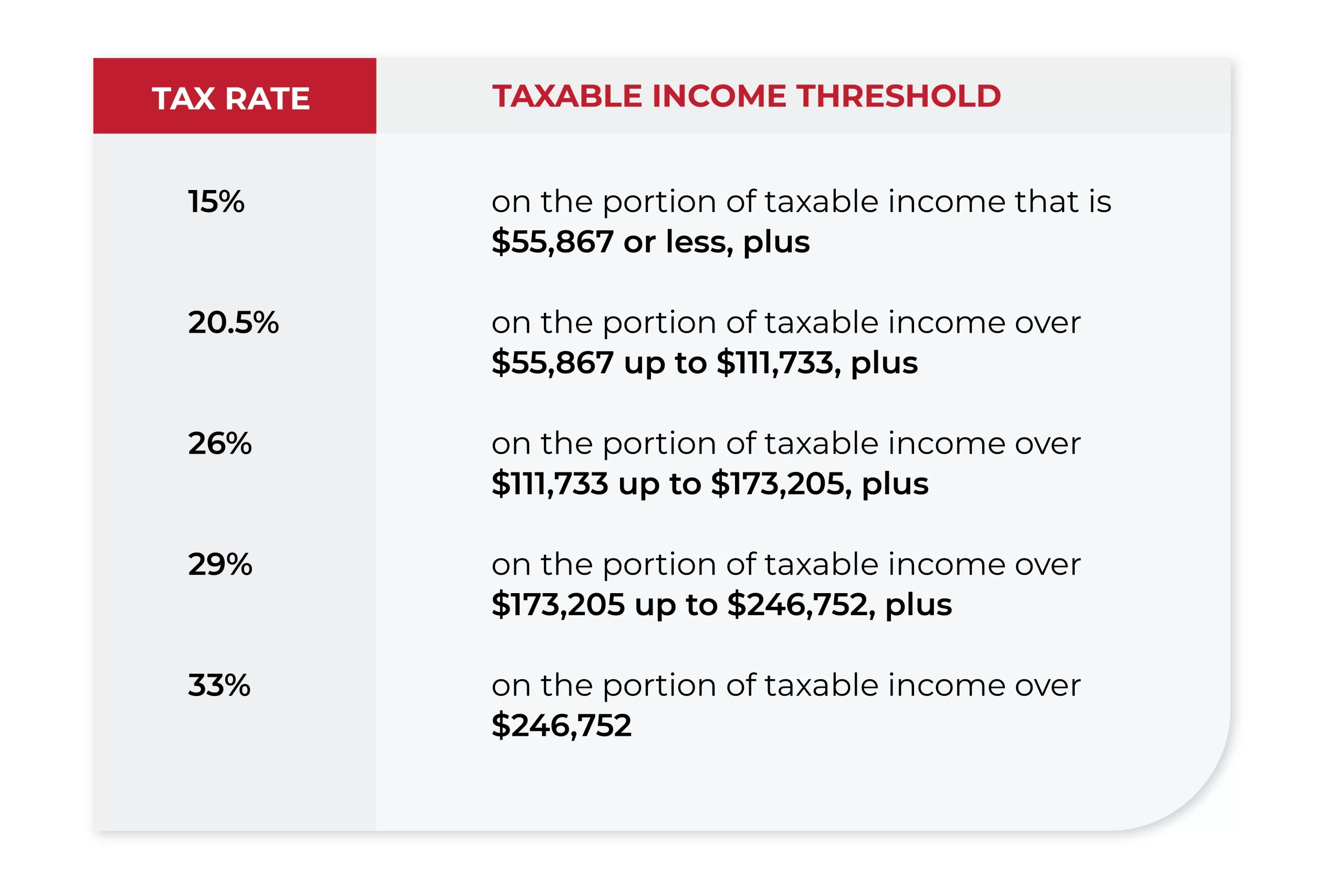

In Canada, Personal Income Tax is collected from individuals from the income that they generate.

- Individuals are taxed on their worldwide income.

- Tax rates are progressive, meaning higher income levels are taxed at higher rates.

- Various deductions, credits, and exemptions are available to taxpayers.

The below table depicts Canadian Federal Income tax rates enforced for the year 2024.

Federal income tax rates for 2024 Goods and Services Tax (GST) and Harmonized Sales Tax (HST)

Goods and Services Tax (GST) and Harmonized Sales Tax (HST)

GST is a federal tax, while HST is a combined federal and provincial tax in some provinces.

Some goods and services are exempt from GST/HST, and others may qualify for rebates.

Corporate Tax

Corporations are subject to federal and provincial/territorial corporate income taxes.

The tax rates vary, and there are also incentives for certain activities and industries.

Tax Filing

The tax year for individuals is the calendar year (January 1 to December 31).

The deadline for filing income tax returns is usually April 30th, but it may be extended if it falls on a weekend or holiday.

Tax-Free Savings Account (TFSA) and Registered Retirement Savings Plan (RRSP)

These are popular tax-advantaged savings and investment accounts in Canada.

Provincial/Territorial Differences

Provinces and territories have the authority to levy their own taxes, leading to variations in tax rates and rules.

Canada Revenue Agency (CRA)

The CRA is responsible for administering tax laws, processing tax returns, and providing information and services to taxpayers.

Tax Credits and Deductions

Various tax credits and deductions are available to individuals and businesses, such as the Child Tax Benefit, Medical Expense Tax Credit, and others.

Laws of Taxes in Canada– A few more to know about…

Small Business Deduction

Canada provides a Small Business Deduction (SBD) to eligible small businesses, which allows them to pay a lower corporate tax rate on a portion of their income. The criteria for eligibility may vary by province or territory.

Capital Cost Allowance (CCA)

The CCA is a tax incentive that allows businesses to deduct the cost of depreciable assets over time. It helps companies recover the cost of capital investments in equipment, machinery, and other assets.

Tax Credits

Various tax credits are available to corporations in Canada, including research and development tax credits, investment tax credits, and other incentives to encourage specific activities or investments.

Taxable Capital

Some corporations in Canada may be subject to a tax on their taxable capital. This is a separate tax based on the capital employed by a corporation.

Transfer Pricing Rules

Canada has transfer pricing rules to ensure that transactions between related entities are conducted at arm’s length, preventing the manipulation of prices to reduce taxable income.

Tax Filing and Compliance

Corporations are required to file an annual corporate income tax return. The filing deadline is generally six months after the end of the corporation’s fiscal year.

Are you planning for Canada immigration? Express Entry Canada is a great choice. It’s a Canadian federal pathway for migrating to the country. Connect with CanApprove to get assistance for Canada immigration. We have been providing industry best Canada immigration services for more than 25 years now. Right from profile evaluation till visa stamping, we will have it all covered. We are a click away! Get in touch!

Thanks for reading! 😊

Goods and Services Tax (GST) and Harmonized Sales Tax (HST)

Goods and Services Tax (GST) and Harmonized Sales Tax (HST)